Find out what Council Tax is and what you need to do to avoid paying it whilst you are a university student.

People living in England, Wales and Scotland pay a local tax that covers the cost of amenities in their area, such as rubbish collection, the police, and the fire brigade. This tax is paid to the local authority and in England, Scotland, and Wales it is called ‘Council Tax’ and in Northern Ireland it is called ‘Rates’.

The short answer is no. If you are a full-time university student you are exempt from paying Council Tax, but you have to let the local authority know your status by following the instructions on their website and submitting the paperwork and evidence that proves you are in full time education.

There is not a simple yes or no answer because even as a student you must meet certain requirements. You will qualify for a full rebate if you fall into one of these categories.

You will be liable for all or part of the Council Tax bill if:

How do you prove you are a student?

What you will need to do to be exempt from Council Tax will depend on which part of the UK you live in.

To find out what you must do log onto the local authorities’ website in your area. You may need proof from your university or college which they will provide to you free of charge.

In some areas you might be able to fill out an online form and the local authority will verify your status directly with your university or college.

Typically, students are exempt from paying Council Tax during the academic year. Therefore, if you live in your accommodation before and after your course starts and finishes you will be liable to pay Council Tax. And remember the end date of your course is not the date of your graduation ceremony and the exemption does not cover the period you are waiting for your exam results. Furthermore, exemption from Council Tax for PHD students ends on the date you officially submit your thesis.

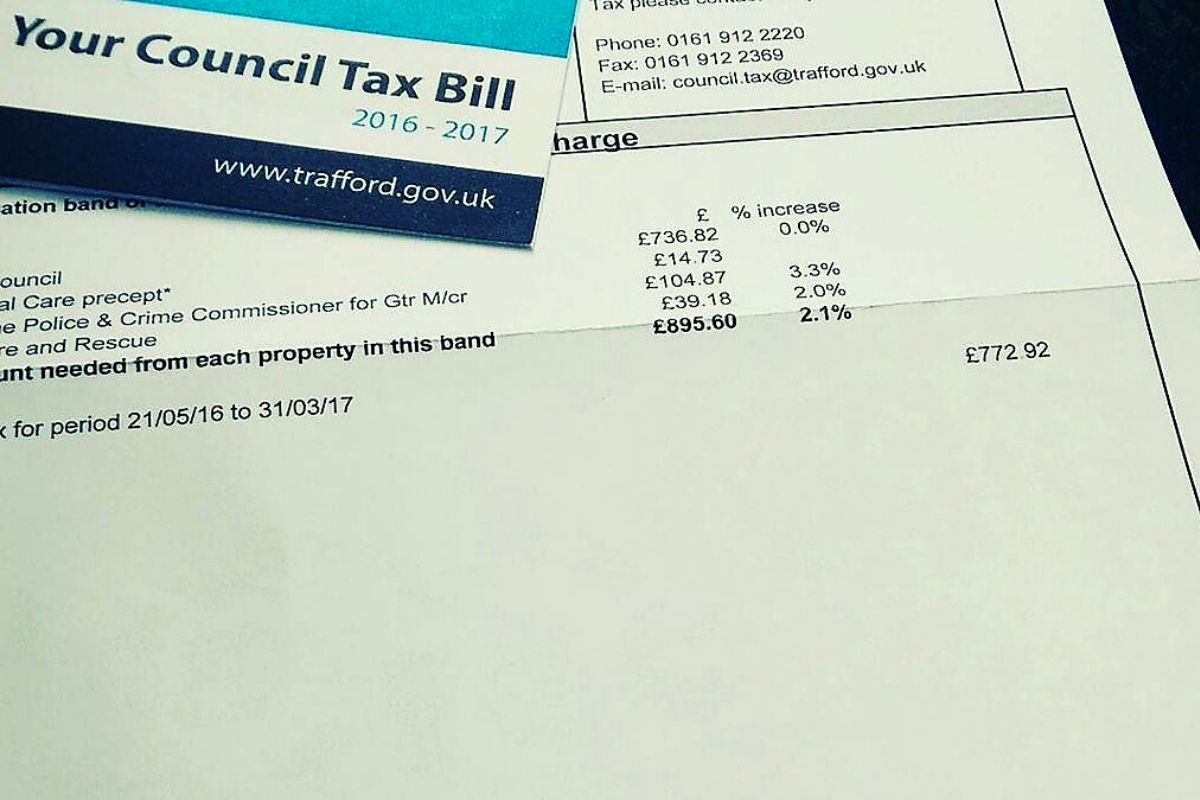

A Council Tax bill is calculated by the local authority based on the value of the property you live in and the number of permanent residents, who are over 18 years old, who live in the property.

The value of the property is calculated by the local authority by placing it into one of eight ‘bands’, and you can check which band your property fall into by going to the Government website and entering your postcode.

A full Council Tax bill is based on at least 2 adults living in a property, with a discount being applied for people living on their own, and for those who live with people who don’t count as adults for council tax purposes, for example, full-time students.

You will be responsible for contacting the local authority and registering for an exemption for Council Tax and providing the evidence to prove you are a fulltime student living in Students Halls, and in some cases the local authority will validate your status as a full time student directly with the university.

When you move into private student accommodation, such as stuhomes, you will be asked to complete a form and provide evidence that you are enrolled onto a full-time course at a university recognised by the local authority. This paperwork will be submitted on your behalf, and you will be exempt from paying Council Tax for the duration of your residency contract. If you stay beyond the academic year you will need to contact the local authority and pay Council Tax.

If you choose to rent a flat or house, then typically you will be responsible for paying the Council Tax, but in some cases the rent will include the Council Tax. To be sure who is responsible for the Council Tax get it written into your rental contract.

It is also worth knowing that if the household is a mixture of people full time students, dependents or those working, then some Council Tax will be payable and the best way to find out how much is to get in touch with the local authority via their website or helpline.

If you miss a few classes because of illness, this will not affect your Council Tax exemption or discount. However, if you suspend studies for a longer period or leave your studies you will need to get in touch with your local authority who will adjust your Council Tax liability.

If you intend to stay in the UK outside term time, such as the summer holidays, you will become liable for council tax and need to get in touch with your local authority.

If you are liable but fail to pay the bill, the local authority will usually start legal proceedings to recover the money. If you disagree with the bill, have difficulty paying, or have allowed arrears to build up and owe a lot of money, you should seek advice from your university or Citizens Advice.

If the bill is wrong, the local authority may agree that you can delay payment until the bill is corrected. However, if you are in dispute about the bill, the local authority may expect you to make some payments while the dispute is in the process of being resolved.

You should contact your local authority immediately if you have received a bill and you think it is for the wrong amount or that you are exempt from paying the bill.

The bill should provide you with instructions of how to notify your local authority. The authority then has two months to decide whether you are liable to pay the bill. If it fails to do so within that time or if you disagree with its decision you can appeal to an Independent Valuation Tribunal.

Find the best student accommodation near your university.